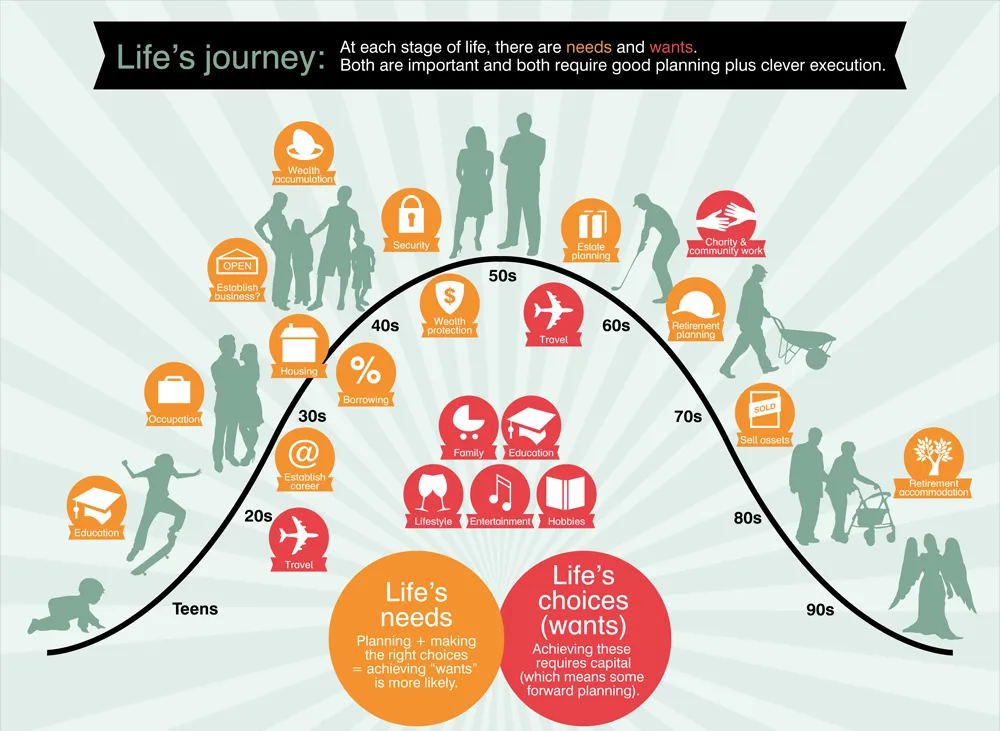

Each person’s financial journey is unique, and we provide custom strategies to fit their individual needs. Through personalized strategies, comprehensive and trusted guidance, we help build - protect - transfer wealth, while offering peace of mind for today and tomorrow.

Taking care of your financial needs in every stage of life is a lot like taking care of your health. That’s why we approach your Financial Needs Analysis (FNA) the same way a good doctor approaches a health check-up—by understanding your unique situation, identifying what needs attention, and creating a personalized plan to help you thrive.

FNA is a four step process:

Step 1 - Understanding Your Situation – The Check-Up

Just like a doctor asks about your symptoms, lifestyle, and medical history, we begin by learning about your financial story.

Step 2 - Diagnosing the Gaps

Once we have the facts, we can assess your financial health. Are you on track for retirement? Are you protected against unexpected events? Are there opportunities to save or plan better?

Step 3 - Personalized Strategies – The Prescription

Based on our analysis, we’ll create a tailored strategy to help you reach your goals.

Step 4 - Ongoing Reviews – Just like Annual Check-Ups

Life changes—so your financial plan should too. We schedule regular reviews to track your progress, adjust for major life events, update goals and strategies.

Your financial well-being is a long-term journey, and we’re here to help for every step. Knowing your finances are in order brings more than just numbers on paper—it brings confidence. With a clear plan, expert guidance, and ongoing support, you can focus on living your life, not worrying about money.

Ready to Check Your Financial Health?

Let’s schedule your Financial Needs Analysis and see how we can help you reach your goals—with clarity, confidence, and care.

Please enter your basic details below and we will be in touch with you to schedule an appointment.